www.aljazeerah.info

Opinion Editorials, June 2020

Archives

Mission & Name

Conflict Terminology

Editorials

Gaza Holocaust

Gulf War

Isdood

Islam

News

News Photos

Opinion Editorials

US Foreign Policy (Dr. El-Najjar's Articles)

www.aljazeerah.info

Curse of Black Gold: Vast Oil Find Puts Guyana on the Verge of Riches - or Failure By Hauke Goos in Georgetown, Guyana Der Spiegel, June 28, 2020 |

|

|

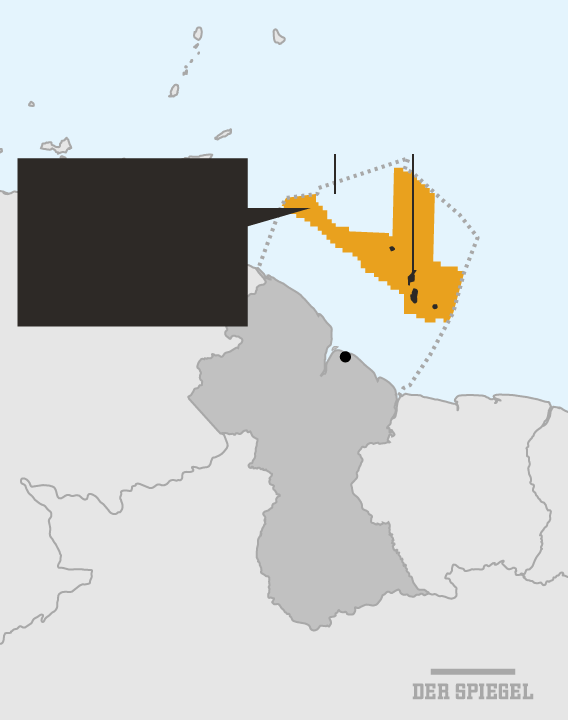

| A street in Guyana's capital, Georgetown | Guyana off shore oil field, June 26, 2020 spiegel.png |

The Curse of Black GoldVast Oil Find Puts Guyana on the Verge of Riches - or Failure

Guyana has always been one of South America's poorest countries. But now that ExxonMobil has discovered a new oil field off the coast, the tiny nation could become one of the world's richest. But will it be a blessing or a curse?

Perhaps everything would be easier if people could actually see the oil. If the drilling platforms, the supply boats and the gigantic specialized vessels used to clean and store the oil were anchored just offshore and not way beyond the horizon. Then, perhaps people would better understand the great lengths that oil companies go to to get at the oil. And better understand just how wealthy the stuff can make you.

The oilfield that ExxonMobil discovered five years ago is about 200 kilometers (125 miles) off the coast of Guyana, which used to be called British Guyana back before anyone was thinking about oil. The result is that the fishermen who sit smoking and chatting on the cement wall built to protect the land from the ocean can see nothing at all from their vantage point. Frigate birds soar lazily through the heat while bright red ibises fly above the mangroves. Everything looks as it always has, but soon, it will all change. That is the hope harbored by many, and the fear felt by some.

The oil off the coast of Guyana is of the highly coveted light sweet crude variety, and it is easily accessible. Some say that by the middle of this decade, Guyana could already be pumping more oil out of the earth per capita than even Kuwait. For the current year, the government in Georgetown issued a pre-corona forecast of oil revenues in the neighborhood of $300 million. The U.S. ambassador to the country said that Guyana could become the "richest country in the hemisphere and potentially the richest country in the world."

It is difficult to describe how oil, how money, transforms a country and a society. One way, of course, is simply by discussing the numbers. One barrel of light sweet crude, which amounts to 159 liters, or 42 gallons, currently sells for around $40. How do you explain to one of the fishermen on the quay, for example, what it would mean for his country if Exxon were to pump 750,000 barrels of oil out of the sea each day? Or a million?

A different view, though, is provided by the Mangal brothers, Lars and Jan, both of whom grew up in Guyana and are four years apart. Their father is a doctor from Guyana and their mother is from Denmark. The fact that they hardly speak to each other anymore also has to do with the oil off the coast of Guyana. It has to do with everything that happens when an entire country is suddenly faced with the prospect of becoming fabulously wealthy.

The question is: Why does sudden wealth overwhelm nearly every society that experiences it? Why does oil initially appear to be a blessing, yet in the vast majority of cases turn out to be a curse?

The Best of the Best

In the 1960s, when Jan and Lars Mangal were born, the small country had just gained its independence from the British. As children, they would play in the reeds down on the Demerara River, which divides the capital of Georgetown before lazily flowing into the Atlantic. At some point, they each headed abroad for their careers, as do most well-educated young people in the country.

Guyana is in the northeastern corner of South America, sandwiched between the Amazon and the Orinoco, with Venezuela to the north, Brazil to the southwest and Suriname to the east. Tourists come here primarily because it doesn't attract a lot of tourists. Guyana, with its 780,000 residents, wrote the travel guide "Lonely Planet," is in the process of becoming "the continent's best-kept ecotourism secret." It has bauxite and gold, but relies more heavily on sugarcane and timber -- all certainly lucrative, but also a bit boring.

Lars and Jan Mangal both opted for careers in the oil industry. Lars went to Schlumberger, the world's largest supplier of oilfield services, while Jan moved to Texas to work for Chevron. Both have traveled widely and both are industry experts. They share the thrill of exploration and the self-confidence of engineers and technicians that comes from a quiet knowledge of being among the best in the world.

Jan Mangal, the older of the two, chose a fish restaurant on Denmark's North Sea coast for our meeting, since he was visiting family in Europe. He hasn't been back to Guyana in more than a year, and his brother has let him know that he may no longer be safe in the country where he was born. So Jan Mangal is left to watch developments in Guyana from afar.

In 2017, President David Granger hired him as an energy adviser. At the time, the contract that the government had with ExxonMobil had just been renegotiated. Essentially, the focus of the negotiations was on how large Guyana's share of the oil profits should be. The oil had already been discovered, and everyone knew that it was one of the most significant finds in recent years. It was normal that negotiating positions would change, and governments in such situations have a fair amount of leverage.

The government of Guyana sent the minister of natural resources to Texas to negotiate on Guyana's behalf. But it was a deal between unequal partners: Guyana's gross domestic product is $4.1 billion, while ExxonMobil's turnover in 2019 was $256 billion.

It isn't known what the minister demanded, or what Exxon offered. But the ExxonMobil team wined and dined him and led him through the company's headquarters -- and by the time he returned home, the contract had been signed.

Dutch Disease

A colonial deal, Mangal said angrily on that evening in Denmark, extremely advantageous to Exxon. It reads as though it were still unclear whether oil had been discovered off Guyana at all, he said. All in all, Mangal said, the agreement meant that Guyana was missing out on billions in revenues.

At the time, Jan Mangal advised the president to renegotiate the deal in order to achieve better conditions for the people of Guyana. Furthermore, he advised, all contracts should be made public. Transparency, he said, was important in a phase that could be decisive for the country's future, while secrecy merely served to promote corruption.

"We have to prove to the world that oil can be used to help the people," he says. "That not just the rich get richer. We have to prove that oil can be done well."

Better, at least, than in Sudan, Nigeria or Equatorial Guinea. A few years ago, 25 sports cars were confiscated in Switzerland, including rare models from McLaren, Koenigsegg and Bugatti. All of them belonged to the son of the president of Equatorial Guinea, whose family apparently saw the oil business primarily as a way to funnel money to relatives and friends.

Or better than in Venezuela, which has the largest oil reserves in the world, yet nevertheless -- or perhaps for that reason -- plunged into crisis, beset by hyperinflation, hunger and a poverty rate that has now risen to 90 percent. In all cases, the sudden prosperity was overwhelming to all -- the people and, especially, the governments.

Experts call this phenomenon "Dutch disease." Through the sale of natural resources, usually oil, export revenues rise. That makes the local currency more expensive, which makes exporting more difficult. Because oil money carries the promise of rapid wealth, countries afflicted by "Dutch disease" neglect traditional industries and agriculture. When the oil money dries up at some point, or the price of oil falls significantly -- as is currently the case -- the economies of such countries have a lack of alternatives.

The brothers Lars (above) and Jan Mangal (below): "Lars will write ... That my life would be in danger were I to return."

Mangal's consultant contract was not renewed: Nobody wanted to hear his suggestions and critiques. At some point, he left his country of birth. Yet as he continues to issue warnings from abroad and maintain an active Twitter presence, his brother Lars returned to Guyana. In Georgetown, he now offers services to those companies involved in the exploitation of the offshore oil reserves.

"My brother is extremely business-minded," says Jan Mangal. "An aggressive-type businessman. He just cares about moving forward. He doesn't care about anything else. Common sense and stuff don't matter." He says he only occasionally hears from his brother via WhatsApp. "Lars will write to my wife, telling her that I shouldn't come back to Guyana. That my life would be in danger were I to return. He probably just wants to scare me. He's trying to keep me away."

His brother isn't interested in democracy or sustainability, Jan Mangal says in parting. "Talk to him. He'd love to meet you. He likes to show off a bit."

The Capital of Confusion

The arrivals hall at the Georgetown airport is new and everything looks as though it has just been mopped. A banner hangs in front of the passport check reading: "Guyana, land of many waters." One of the first things you notice on the way into the city are the numerous cleared lots on the banks of the Demerara. Riverside property is highly sought after, because the oil industry needs space for ports and refineries. "For Sale" signs can be seen in front of most of the lots.

With a per capita income of $5,252, Guyana is the third-poorest country in South America and Exxon's discovery was celebrated like a long-coveted lottery jackpot. The degree to which oil has already changed the small country can be seen in the boisterousness that can be heard everywhere.

Guyana, says one investment banker, is currently experiencing a "tsunami of opportunity." Guyana, says the incumbent prime minister, is "the new Oil Dorado." The oil industry, says the country's best-known environmental activist, is pursuing a kind of colonialism.

"The sky is the limit." That maxim is on the lips of all those streaming into Guyana from all over the place, lured by the possibility of becoming extremely rich in an extremely short amount of time.

A lawyer who specializes in corruption, however, has another description for the country: "A lost cause."

Politicians in Guyana are discussing crucial issues with environmental activists, company executives with good-governance attorneys and locals with foreigners. The focus of many such discussions is on cronyism, corruption and greed. Georgetown, says a PR expert who runs the website OilNow in the capital city, has become "the capital of confusion."

Not Rich, but Less Poor

The country had actually established concrete goals for its future, committing to getting 100 percent of its energy needs from renewable sources by 2025. Almost all of the country's densely populated coastal areas lie below sea level. Turning away from fossil fuels would have been very much in the country's self-interest.

"And then, the oil came," says Melinda Janki, an activist in Georgetown for democracy and the environment. She believes both are just as vital as they are endangered.

Janki is a small, impatient woman who lives in the historical center of Georgetown in a home covered by vegetation. Visitors must make their way past several dog kennels. She completed her university studies in London and speaks with a pleasant British accent. For a time, she worked as an attorney for BP.

The people of Guyana were fed a fairy tale, Janki says, because it just so happens that people love fairy tales. This particular tale? Oil leads to happiness. Guyana, according to the story everybody is telling, is like a gambler who had been dreaming of the top prize for years, and then suddenly, it raked in the pot.

Janki has looked at the numbers -- the amount that will be pumped out of the sea, the production costs, the license fees and the profit sharing. According to the contract the minister of natural resources negotiated with Exxon, Guyana is to receive 52 percent of the profits. The global standard is between 65 and 85 percent.

In every contract, though, there are passages that define what counts as profit -- and there are plenty of opportunities to shave numbers off that 52 percent until there is hardly anything left. The longer Melinda Janki speaks, the clearer it seems to become that under the current contract, Guyana won't end up fantastically wealthy but, in the best case, a bit less poor.

The Norwegian Model

No matter where in the world oil is discovered, the focus is never on making the locals wealthier, says Janki. "Oil only makes the oil companies rich."

There is, though, one exception -- and it serves as an example for almost every country where oil is discovered: Norway.

Until the early 1970s, Norway was one of the poorest countries in Europe, with an economy largely dependent on agriculture, shipping and fishing. But then, oil and natural gas deposits were developed and most of the profits earned by the largely state-owned oil companies flowed into the public pension scheme. It is essentially Norway's insurance for the future: Each year, the government is allowed to spend a maximum of 3 percent of the volume of the fund on projects beneficial to society. Today, the Norwegians enjoy one of the highest standards of living in the world.

Can Guyana become the next Norway? Janki smiles. Norwegians, she says, are extremely well educated, have a high environmental awareness and a strong sense of community. And they have a single culture. Guyana, she says, is home to deep ethnic rifts and mismanagement of its natural resources has a long tradition. Norway is well-known as a tough negotiating partner, Janki says, and Norwegians seek out advice and listen to it. "The government of Guyana does not take expert advice, apparently doesn't even know that it needs to take expert advice."

Jan Mangal is, of course, familiar with the Norway example. And he also knows that Guyana isn't in the best position to follow that example, even if it was able to make improvements to its contract.

Corruption, for example, is part of everyday life in Guyana. The people are poor and they have grown used to accepting small gifts as a way of improving their low incomes. On the Corruptions Perceptions Index kept by Transparency International, Guyana is ranked 85th.

Greed or Just Plain Incompetence?

Corrupt governments are weak, and strong companies, like ExxonMobil, are able to take advantage. It is quite pleasant to negotiate with politicians who are primarily interested in funneling as much oil money as possible into their own personal bank accounts.

In 2017, a whistleblower got in touch with Christopher Ram, one of Georgetown's best-known lawyers and a prominent critic of the oil deal. As a result, it came out that as part of the contract negotiations, ExxonMobil had paid a standard, if low, "signing fee" of $18 million. A short time later, it was revealed that the Finance Ministry had placed the money in a hard currency account instead of paying it into the fund intended for the purpose. The government insisted that it had been seeking to earn interest to serve the country.

Ram has long, gray hair and doesn't wear shoes in his office, which helps attract attention to his turquoise-colored socks. He has a column in the local paper, Stabroek News, his own television show and enough money to be open with his opinions whenever he sees fit.

Even more than greed, he says, the oil find has revealed incompetence. "I think that the minister of natural resources didn't even read the contract before he signed it," he says. It is particularly problematic, Ram believes, that the corruption comes from the very top.

Does he mean to say that Exxon essentially bought the advantageous contract in 2015 for $18 million?

"Essentially, yes."

Is the minister who negotiated this deal corrupt?

"Possibly. I think so."

Ram sinks deeper into his chair and smiles. "The quickest way to make money in Guyana is politics. The quickest way to become a millionaire is politics."

The government denies all corruption allegations.

A Matter of Perspective

In 2015, shortly before oil was discovered, the government awarded mineral rights for two areas directly next door. The possibility that those areas were also home to oil deposits was significant.

One of the areas was awarded to Mid-Atlantic Oil & Gas together with JHI Associates Inc. A short time later, Exxon joined them as "operator." The other area was awarded to the two companies Ratio Energy and Ratio Guyana. Exxon joined them too to carry out the exploration.

There are reasons to suspect that these companies were merely strawmen. One of them had only recently been founded, with headquarters in the tax haven of the Virgin Islands.

The Guyana investigative body State Assets Recovery Agency (SARA), which was tasked by the president with scrutinizing the companies, has spoken of "significant irregularities." The agency head said that the Virgin Islands "is a clear red flag."

"It is like a human comedy under a magnifying glass," says Christopher Rahm. "Everything becomes quite clear to the people from the outside: greed, stupidity, incompetence, ambition and the desire for a nice lifestyle."

Will Guyana ultimately profit? Or will it lose out?

Well, says Rahm as he stretches out his turquoise-colored feet: "If you have a right to 100 percent and you only get 60 percent in the end, have you gained 60 or lost 40?"

Exciting Times

On a recent Friday afternoon, a rather small man walks across a sandy lot and up the stairs into a steel structure, where a press conference is scheduled to take place. The structure used to be the bridge of a ship, but Lars Mangal, the brother of the former energy adviser Jan Mangal, had all the technical equipment removed and placed two desks inside.

After working for the oilfield services company Schlumberger, he joined a small, Danish company. He is in constant motion and almost always reachable. In response to a WhatsApp query as to whether he would like to talk, he responded within eight minutes: "Yes, I can chat."

When Exxon found oil in 2015, Lars Mangal decided to take advantage of the opportunity. Exxon would need local expertise in addition to workers from Guyana and Lars Mangal decided that he would be the one to supply both. He moved back to Georgetown, rented a piece of property not far from the river and offered his services to Exxon.

At the same time, he founded an academy to train young people for jobs in the oil industry. On this particular Friday afternoon, 50 trainees are to graduate. They are waiting in the sun outside, young men and a couple of women in black pants and white T-shirts. Some of them used to work in the sugar industry. They are the third class of trainees educated by the academy. And every single one of the 50 graduates, Jan Mangal says proudly, already has a job.

Up in the former captain's bridge, he welcomes the prime minister of Guyana, the British high commissioner and the minister of natural resources, a heavyset, somnolent man. He is the one who negotiated the contract with Exxon.

The minister speaks of "exciting times" and about the promise that the future holds. The prime minister says Guyana is on a path to becoming "the richest oil country on Earth, when measured by income per capita."

Lars Mangal nods along with every word. He had no trouble finding partners and financial backers for his project, and he is now thinking about opening up a branch in London. When it is finally his turn to speak, he speaks glowingly of "a new frontier for the oil and gas industry."

He has named his offices after space exploration missions like Apollo, Enterprise and Pioneer. Just the successful ones, he says with a laugh. And he is full of superlatives, saying that the project of exploiting such an oil field is similar to the effort "to put a man on the moon." Hyperbole is in no short supply in Georgetown.

"This is unique," Mangal says. The size, the scale, the speed, the amount of oil thus far discovered. The amount of oil that Norway found in 10 or 15 years, he says, was discovered in Guyana within two or three years. "This here is massive."

"Run It Like a Company"

What does Lars Mangal think of his brother's criticism and his demand that the contract with Exxon should be renegotiated and drilling licenses retendered? And what about the efforts to distribute the billions in oil money as fairly as possible for the benefit of all in Guyana? "Jan is more of a theorist. I see opportunities and I grab them. Either we're involved, or we aren't. If you want to influence something, you have to join in. You can only change things if you're a part of it."

Ram, the critic, and Janki, the attorney: "It is like a human comedy under a magnifying glass."

Finally, once all of the graduates have received their certificates and all of the speeches have been held, Mangal invites his guests for some coconut water and snacks. Balloons float into the air, photos are taken, and business cards are exchanged. The sound system plays "Heal the World" by Michael Jackson.

It is, perhaps, one of Lars Mangal's business partners -- a small man from Singapore who had travelled in for the occasion -- who describes the situation in Guyana best. When asked what should be done in the country, he says: "Run it like a company."

Elections were held in Guyana on March 2. The election had to be ordered by the courts because the president had lost a confidence vote. He launched a legal challenge against the constitutional mandate that a new parliament had to be elected within 90 days, but the bid proved unsuccessful.

The Elections Commission initially declared the governing party victorious, despite questions from the very beginning about how the votes were counted. It was then decided that the votes would have to be counted again.

Since then, almost four months have passed without a victor having been declared. "We are seeing the well-known signs of failure," says Jan Mangal over the phone. "There are all kinds of warning signs on the road, but we just keep on driving, undeterred. It is sad for Guyana."

"Extremely unsettling," says Lars Mangal, who wants the election results to finally be announced, no matter who wins. Already, he says, too much time has been wasted. "Our options are growing more and more limited."

For one brother, everything is going too fast, for the other, too slow. And it is possible that both are right, which doesn't make things easier for Guyana.

Here's a Crazy Idea

How, though, does a government intend to self-confidently go into business with a company like ExxonMobil if it can't even count votes properly?

Prior to the botched election, a discussion evening took place in Georgetown, capital of the new "Oil Dorado." It was held in Moray House, a beautiful, wooden, colonial-era structure on the corner of Camp and Quamina Street, with high ceilings and the pleasant whirring of hummingbirds out by the porch.

The lawyer Melinda Janki was sitting up front. She had written in an email that she would be talking about oil and would try to link the ideas of "dignity" with "natural heritage" -- clean water, clean air, species diversity. "Land of many waters."

Janki reminded her listeners of the obligation that today's generation has to future generations and she spoke of the constitutional right to a healthy environment. In her pleasant British accent, she linked the danger of an oil spill with global warming and the question as to what makes life worth living.

In the audience, on a sofa in the front row, sat Annette Arjoon, Guyana's best-known environmental activist. She lives in a neighborhood of large houses on expansive lots called Oleander Gardens, just a few meters from the Atlantic. People have recently started referring to the neighborhood as "Oileander Gardens" because of the many new residents from the oil industry who don't mind paying $4,000 a month in rent.

At some point, Arjoon took the floor. She has just a single question, she said, sitting up a bit straighter. She was well aware that her question would stand everything on its head -- and that it was rather impertinent. It was also a question that neither Jan nor Lars Mangal had ever considered.

Would it not be a possibility, said Arjoon, to just leave the oil in the ground?

***

Share the link of this article with your facebook friends

|

|

|

|

||

|

||||||