www.aljazeerah.info

Opinion Editorials, September 2015

Archives

Mission & Name

Conflict Terminology

Editorials

Gaza Holocaust

Gulf War

Isdood

Islam

News

News Photos

Opinion Editorials

US Foreign Policy (Dr. El-Najjar's Articles)

www.aljazeerah.info

The Shale Delusion:

Why The Party's Over For US Tight Oil

By Art Berman

Oil Price, Al-Jazeerah, CCUN, September 28, 2015

|

|

The party is over for tight oil.

Despite

brash statements by U.S. producers and misleading analysis by Raymond

James, low oil prices are killing tight oil companies.

Reports

this week from

IEA and

EIA paint a bleak picture for oil prices as the world production

surplus continues.

EIA said that U.S. production will fall by 1

million barrels per day over the next year and that, "expected crude oil

production declines from May 2015 through mid-2016 are largely

attributable to unattractive economic returns."

IEA made the point

more strongly.

"..the latest price rout could stop US growth in

its tracks."

In other words, outside of the very best areas of the

Eagle Ford, Bakken and Permian, the tight oil party is over because

companies will lose money at forecasted oil prices for the next year.

Global Supply and Demand Fundamentals Continue to Worsen

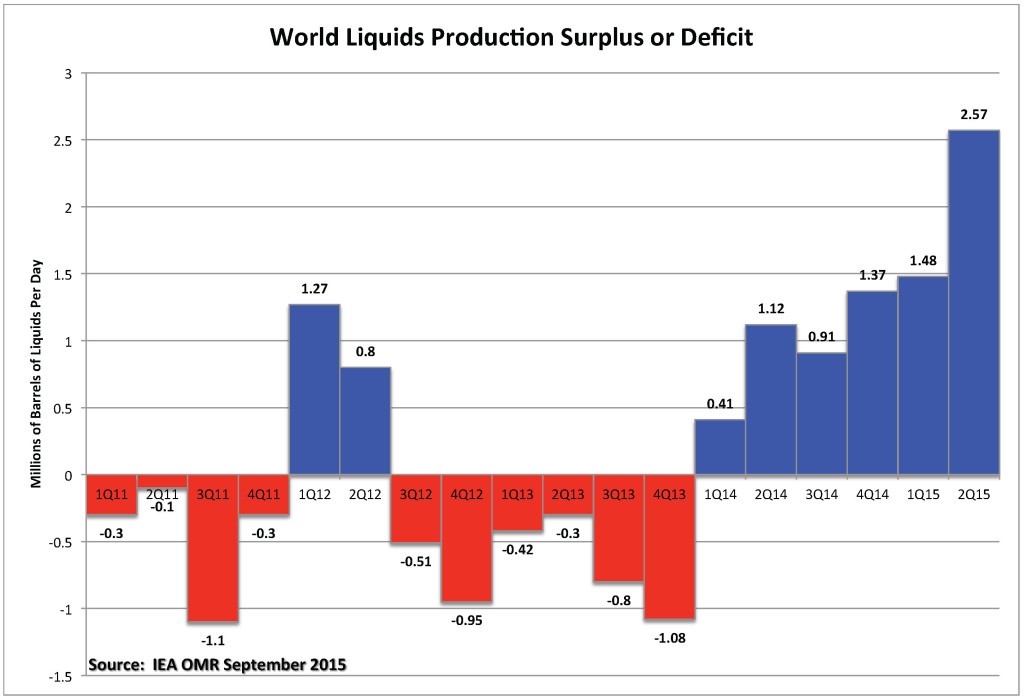

IEA

data shows that the current second-quarter 2015 production surplus of 2.6

million barrels per day is the greatest since the oil-price collapse began

in 2014 (Figure 1).

Figure 1. World liquids production surplus or

deficit by quarter. Source: IEA and Labyrinth Consulting Services, Inc.

Image URL:

https://oilprice.com/images/tinymce/artltoparty1.jpg

Larger Image URL:

https://oilprice.com/images/tinymce/artltoparty1.jpg

EIA monthly data for August also indicates a 2.6 million barrel

per day production surplus, an increase of 270,000 barrels per day

compared to July (Figure 2).

Figure 2. World liquids production,

consumption and relative surplus or deficit by month. Source: EIA and

Labyrinth Consulting Services, Inc.

Image URL:

https://oilprice.com/images/tinymce/artltoparty2.jpg

Larger Image URL:

https://oilprice.com/images/tinymce/artltoparty2.jpg

It further suggests that the August production surplus is because

of both a production (supply) increase of 85,000 barrels per day and a

consumption (demand) decrease of 182,000 barrels per day compared to July.

The world oil demand growth picture is discouraging despite an

increase in U.S. gasoline consumption (Figure 3).

Figure 3. World

liquids demand growth. Source: EIA and Labyrinth Consulting Services, Inc.

Image URL:

https://oilprice.com/images/tinymce/artltoparty3.jpg

Larger Image URL:

https://oilprice.com/images/tinymce/artltoparty3.jpg

World liquids year-over-year demand growth has fallen by almost

half from 2.3 percent in September 2014 to 1.2 percent in August 2015.

This is part of overall weak demand in a global economy that has been

severely weakened by debt.

The news from both IEA and EIA is, of

course, terrible for those hoping for an increase in oil prices.

U.S. production has fallen 510,000 barrels of crude oil per day since

April 2015 while OPEC production has increased 1.2 million barrels per day

since the beginning of the year (Figure 4). U.S. production increases in

the first quarter of 2015 were partly because of an oil-price rally that

ended badly this summer, and because of new projects coming on-line in the

Gulf of Mexico.

Figure 4. OPEC and U.S. crude oil production.

Source: EIA and Labyrinth Consulting Services, Inc.

Image URL:

http://cdn.oilprice.com/images/tinymce/Copy%20of%20artltoparty4.jpg

Larger Image URL:

https://oilprice.com/images/tinymce/artltoparty4.jpg

It appears that OPEC is winning the contest with U.S. tight oil

producers to see which can continue to over-produce oil at low prices. IEA

ended its September

Oil Monthly

Report saying,"On the face of it, the Saudi-led OPEC strategy to

defend market share regardless of price appears to be having the intended

effect of driving out costly, "inefficient" production."

In other

words, tight oil and oil sands production.

With Iran poised in

early 2016 to add almost as much oil as the amount of the U.S. production

decline to date, the outlook for tight oil producers could not be worse.

And yet, the sell-side analysts and investment bank research groups

continue to chant the refrain of logic-defying hope for tight oil

producers in the face of crushingly low oil prices.

Party

On, Dude!

This week,

Raymond James joined the chorus with its bewildering "Energy

Stat: U.S. Operators' Response to Low Oil Prices? Get More Efficient!"

The message is all about rig productivity and drilling

efficiencies. I showed in my

post

last week that these measures are nothing but red herrings to distract

from the unavoidable truth that all tight oil companies are losing money

at current oil prices.

I would like to say that Raymond James is

simply repeating the shop-worn and illogical cliché that "We're losing

money but making it up on volume" but it's much worse than that.

There is no mention of money in the report. There is not a single dollar

sign ($) in the text or figures nor are there are there any costs, prices

or cash flows mentioned. That seems odd since Raymond James is, after all,

a financial advisory company.

Raymond James presents 30-day IP

(initial production rate) data to show that everything is fine and getting

better in the tight oil patch.

Really guys? Is that why oil

companies are laying off staff, cutting budgets and selling assets?

Besides, everyone knows that IPs are a practically meaningless

predictor of EUR or profitability, and something that producers often

manipulate to create press releases in order to satisfy investors.

Nonetheless, they forecast "2015 to be a banner year for both oil/gas

well productivity gains." Interesting but irrelevant since it's going to

be an atrocious year for profits.

Here is my table from last

week's

post

for the best of the tight oil companies in the best parts of the plays.

Table 1. First half (H1) 2015 cost per barrel of oil equivalent

summary for Pioneer, EOG and Continental. Source: Company SEC filings and

Labyrinth Consulting Services, Inc.

Image URL:

http://cdn.oilprice.com/images/tinymce/Copy%20of%20artltoparty5.jpg

EOG, Pioneer and Continental lost between $10 and $24 per barrel

in the first half of 2015 but Raymond James says, "Never mind and party

on, Dude!"

This report by Raymond James is both misleading and

clearly out-of-touch with the price and investment environment that the

International Energy Agency and the Energy Information Administration

describe.

Conclusions

ExxonMobil CEO Rex

Tillerson summarized the situation this week in an interview with

Energy Intelligence:

"It [tight oil] will compete. Will all of

it compete at all pricing? No."

For the next year or so, tight oil

wells will not be commercial except in the best parts of the best plays.

Tight oil companies will lose money. For the most part, the efficiency

gains are behind us.

Until market fundamentals of supply and

demand come into balance, prices will remain low.

Goldman Sachs predicted yesterday that U.S. oil prices through the

first quarter of 2016 will be "low enough to discourage investment in new

oil production and shrink the global glut of crude."

Clearly for

now, the party is over for tight oil.

Article Source:

http://oilprice.com/Energy/Crude-Oil/The-Shale-Delusion-Why-The-Partys-Over-For-US-Tight-Oil.html

***

Share this article with your facebook friends

|

|

|

|

||

|

||||||